SUPPLY CHAIN HEAVYWEIGHTS AND STARTUPS NEED TO COLLABORATE AS WELL AS COMPETE, TO MANAGE DISRUPTION AND DRIVE PROGRESS.

The past image of the supply chain and logistics industry conjured up ideas of solidity and old-fashioned but dependable infrastructure: getting the job done in proven ways, putting reliability ahead of speed, preferring validated methods to innovation. But the increasing pace of market change and disruption, driven by industry startups, shifting customer expectations and reduced margins, means that established market leaders must evolve in order to survive.

Today, anyone with a smartphone has in their hand the means of ordering anything from anywhere on the planet, but the accompanying delivery methods could still lag behind if left solely in the hands of traditional supply chain and logistics services. Startups are seizing the opportunity to plug some of the gaps, especially in urban areas, with internet ordering platforms, pricing transparency, AI and robotics. So, how can the weighty market leaders and the nimble newcomers cooperate – perhaps while still competing – to help each other?

INTENSIVE STARTUP ACTIVITY IN THE LAST FIVE YEARS

The industry has been dominated by the big names for several decades now: globally, UPS, FedEx and DHL, and locally, bulk rail carriers like Aurizon and Pacific National, and road haulage operators such as Australia Post and Linfox. They employ enormous numbers of diverse professionals, and their sheer scale made it difficult, in the past, for startups to even think about competing with them.

But their previous market stranglehold is being challenged by the likes of Freightos, Bossa Nova Robotics, Shippo, Robby Technologies, Drive.ai, FreightExchange, GetSwift and Parsl. These new entrants are harnessing AI, big data, cloud computing, blockchain, the Internet of Things connectivity, 3D printing, automation and robotics, to create niche markets relying heavily on technology but relatively undemanding in terms of expensive infrastructure. They are exploiting customer demand for faster delivery times, lower prices, convenience and flexibility. And they need tech-savvy professionals who can quickly master the new skills required to architect and manage the ever-increasing complexity of supply chains.

The traditional markets leaders are likely to find it more difficult to respond to changing market dynamics because of their large and often unwieldy bureaucracy and slower decision-making processes. Yet they do have one major advantage over the disrupters: by and large, they remain in control of the tangible assets required to transport goods over large distances. There are competitive challenges and advantages in collaboration for businesses at both ends of the marketplace.

THE ELEMENTS OF DISRUPTION IN THE INDUSTRY

- Big data inevitably produced by supply chain companies every day, can be analysed and used to streamline processes.

- Artificial intelligence frees the human workforce from routine processing tasks, releasing them into more productive areas, thus creating new jobs as well as replacing old ones. By carrying out data analytics, AI enables better decision making and predictive analysis of customers’ logistics needs.

- Cloud computing allows systems to grow along with the business while improving accessibility and flexibility for a mobile workforce and extremely widespread customer base.

- Blockchain is being used for supply chain tracking and for confirming the provenance of goods.

- The Internet of Things promotes end-to-end connectivity, integration and information-sharing throughout the distribution process.

- 3D printing could dramatically reduce the need to keep an inventory of items like spare parts while speeding up order fulfilment.

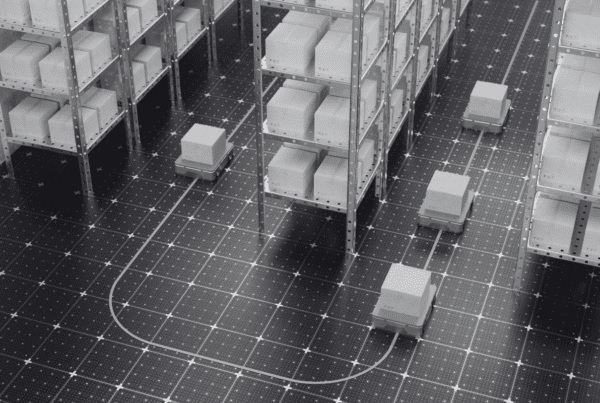

- Robots can be used for swift and error-free warehouse placement and retrieval of goods, while both ground-based robots and aerial drones are likely to feature increasingly in last-mile delivery in metropolitan areas.

- Automation is not confined to robots. Automated conveyors can be used on fixed warehouse or factory routes, while automated check weighing systems detect underweight packages where components may be missing.

- Remote systems may include innovations like supplying a device which allows a delivery service provider to remotely open the order recipient’s car boot, garage door or secure drop box.

- Green products and materials are a feature of startups. Battery-driven delivery robots will produce far less pollution than a diesel-powered vehicle. Biodegradable packaging made from shrimp waste is far kinder to the environment than the polystyrene foam sitting in a landfill or polluting the ocean.

- Transparency around pricing is being fostered by internet platforms and mobile apps allowing service suppliers to bid for jobs, and letting customers compare quotes.

HOW (AND WHY) SHOULD BOTH OLD AND NEW COMPANIES WORK TOGETHER TO HANDLE DISRUPTION?

It all adds up to a lot of change concentrated into a very short time frame. Supply chain and logistics organisations have to match this pace by adapting at the same speed. Older, larger companies may need to adopt strategies that are different from those of their younger competitors, but working together could suit both groups.

STRATEGY FOR ESTABLISHED PLAYERS: CONNECT WITH DISRUPTION INSTEAD OF FEARING IT

There’s more than one way to handle a threat. You can ignore it, fear it, try to emulate it, or harness it by turning it into an opportunity. Ignorance and fear are unlikely to produce good results, but emulation and targeted harnessing can pay dividends.

Established supply chain companies can cope with disruption by forging closer links with their agile and progressive competitors. According to UK advisory firm Deloitte, they can do this in a number of ways:

- Collaborate: Collaboration could take many forms. Since startups mostly rely on traditional logistics companies to supply the infrastructure required to physically transport goods over long distances (trucks, railway engines and rolling stock, ocean-going vessels, cranes and other goods-handling equipment), the asset-sharing partnership could become more formalised. At the same time, larger corporations can sponsor startup accelerator programs (such as Slingshot Accelerator) and benefit from the exposure to new ideas for their own industry.

- Incubate: The innovation capacity of mature companies should not be underestimated. They own an enormous quantity of data waiting to be mined and analysed, and they have skilled professionals on board (or able to be hired) who can lead the company in new directions via internal incubation programs. As a result, they may be able to expand their existing services to match the startups’ offerings, or create spin-off companies. Either way, revenue is likely to increase.

- Invest: Another way to keep a finger on the pulse of innovation is to provide seed investment capital for startups, or invest in the further development of businesses who have already made some progress but are chafing at the bit through lack of funding.

- Acquire: If services offered by startups expose the gaps in a more conservative company’s facilities, it’s possible to fill the gap by simply acquiring the embryo organisation and its in-house expertise.

STRATEGY FOR STARTUPS: SHARE AND LEARN

On the other side of the coin, startups are not exempt from competitive forces. They have chosen to enter an arena populated by both veteran giants and by other nimble minnows like themselves. As well, they are light on assets, and may need to find ways to cooperate with the companies who are actually moving goods along all but the last few miles, if not all the way. This cooperation could involve actively looking for mentorship, or investment funding, or being open to an acquisition.

Additionally, they may need to examine the ways in which mature organisations have succeeded in creating a sustainable business model. For example, if they have themselves chosen to specialise in ‘last mile’ delivery in metropolitan areas, do they need to expand into longer-distance services? If they only provide a service to compare prices or identify spare capacity, can they leverage this data by actually providing a physical carrier service?

STRATEGY FOR ALL PLAYERS: ATTRACT AND RETAIN THE FUTURE WORKFORCE

It’s clear that these disruptive forces need to be not merely managed but actively exploited by a motivated workforce, if market size and market share are to grow. CEOs, hiring managers and all industry leaders need to commit to innovation and engage the people who propel it. Here are some recommendations for how to set about doing exactly this:

- Develop existing in-house skill sets needed to design and manage diverse supply chains. Build a talent pipeline by identifying and training your future leaders.

- Identify exceptional talent from other industries rather than confining your search to your own backyard. Consider, for example, data scientists, risk managers, and business development analysts. Create new senior roles such as Disruptive Technologies Engineer and Digital Engineer, to drive innovation. Put creativity and emotional intelligence on your list of desirable employee attributes and be prepared for a workforce possibly more diverse than the one you are employing now.

- Find ways to retain your best talent because salary and incentives are no longer enough for today’s aspirational workforce. They seek meaning and purpose (think Google’s “Do cool things that matter”) and if they can combine these with the kind of salary they are looking for, they won’t hesitate to jump ship in favour of the supply chain equivalents of Uber, Amazon and Airbnb. Take a critical look at your existing management structure and redesign it to foster flexibility and speedier decision-making.

- Invest in innovation to help develop a strong Employer Brand and Employee Value Proposition that will attract and retain the kind of disruption-ready talent that will serve you best.

DEPENDABLE CORPORATES + CUTTING-EDGE STARTUPS = A WINNING COMBINATION

There are substantial benefits to be gained from collaboration by both incumbents and newcomers in the supply chain and logistics marketplace.

Strong, existing players have a solid capital backing, often with further investment capacity, plus an experienced workforce with collective decades of experience in sustainable profitability. But they may be ponderous, lacking in new ideas and adaptability, and, frankly, boring to work for. As a result, they could find the current pace of disruption a serious challenge, and lose market share.

Agile, nimble, innovative recent arrivals, on the other hand, have a surfeit of ideas begging to be exploited, superior understanding and use of advanced technology, and often a more flexible management and decision-making process. All of this adds up to a strong Employee Value Proposition. But they have a tendency to lack the physical assets which populate the long-distance haulage market, a predisposition to focus on smaller niche markets, and a shortfall in both long-term business experience and working capital.

Combine the two with collaboration in the form of asset-sharing partnerships, external accelerator and internal incubator programs, seed and development investment and acquisition, and everyone can win. And that includes the industry’s customers, who are already benefitting from a more client-centric, flexible, fast-moving and transparent marketplace.

Despite, and in some cases because of, technological disruption, supply chain and logistics will always be a business which relies on the capabilities of its people first and foremost. Secure your company’s place in a changing world by attracting your future-ready talent now. Click the button below to download our 15 Tough Interview Questions To Ask Supply Chain Executives.